Mobile Banking

Manage your accounts anytime, anywhere with our Mobile App.

Manage your accounts anytime, anywhere with our Mobile App.

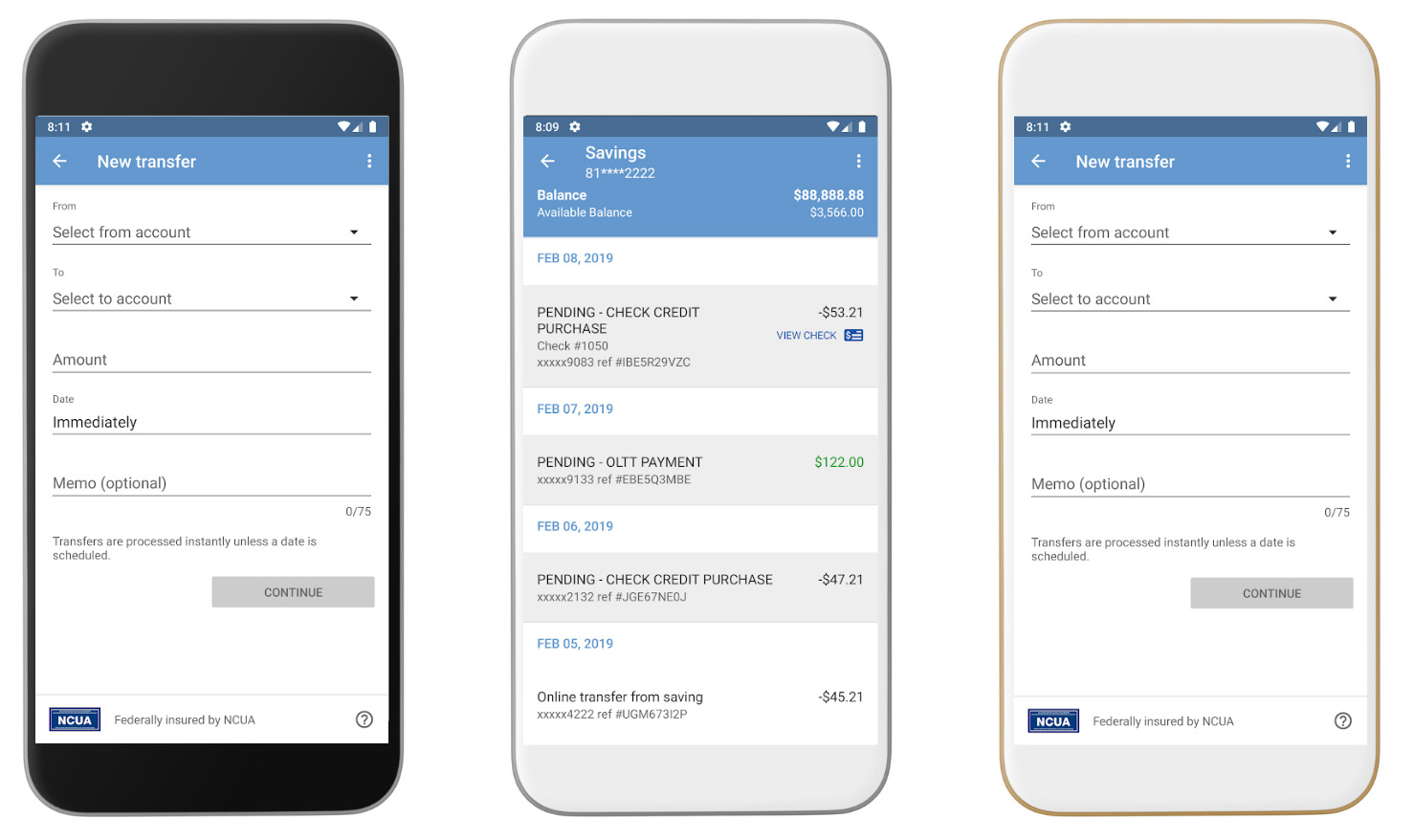

Access your account, deposit checks, and even send and receive secure person-to-person payments via your iPhone or Android with the CCU Mobile App.*

Making a deposit to your account is easy, safe, and secure with the Mobile Deposit feature located within our CCU mobile app (iPhone or Android cell phones).

Within the CCU mobile app, you will be able to snap a picture of the front and back of a check, and then both images, along with the dollar value, are transmitted to the credit union for approval.

Enjoy Fast, Convenient, and Secure Login To The CCU Mobile App! Facial recognition and fingerprint authentication is available to the CCU Mobile app for compatible iPhone and Android smartphones.*

To enable fingerprint authentication, open the CCU Mobile app, go to the “More” tab and select “Face ID” or “Touch ID” depending on your device type and toggle it on. You will now be able to sign-in to the mobile app using a registered face or fingerprint on the device.

*The availability of authentication via biometrics is dependent on your individual device type.

Consumer Credit Union continues to offer competitive deposit rates amongst our peers. Visit any of our convenient locations to open an account or open an account online today!

While there is no way to eliminate the risk of identity theft, we are offering our qualified members an affordable solution which will help address the risks of fraud and ID theft.